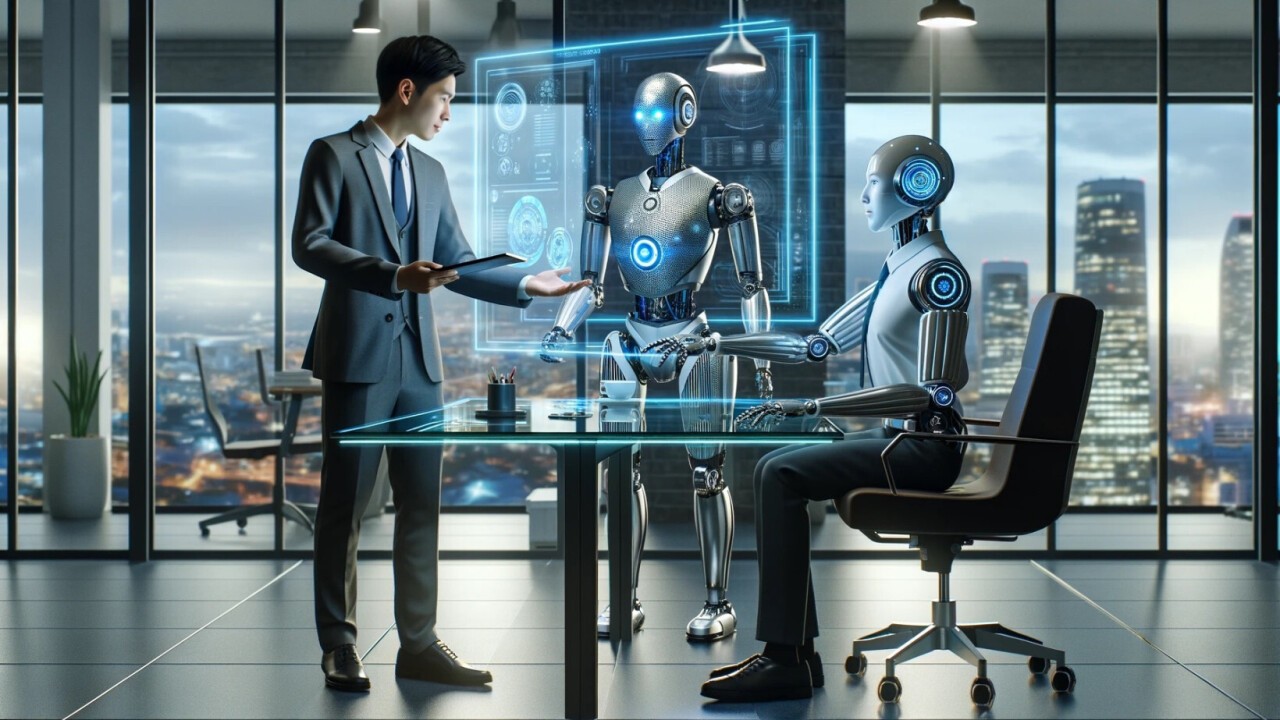

Transforming Banking Operations with AI Agents

Real Stories, Real Results – Optimizing Financial Services with AI Agents

A Success Story in the Financial Sector

Problem:

FutureWealth Bank, a prominent wealth management firm, faced challenges with manual compliance checks, slow customer response times, and high operational costs. The manual handling of financial transactions and client requests not only delayed service but also increased compliance risks and costs.

Key issues included:

Slow Customer Service Response: Manual processes for handling client inquiries resulted in longer response times and reduced customer satisfaction.

Inefficient Compliance Checks: Compliance processes were manually managed, leading to slower processing and increased regulatory risk.

High Administrative Costs: Routine administrative tasks, such as data verification and reporting, consumed significant staff time and increased costs.

A Success Story in the Financial Sector

Solution:

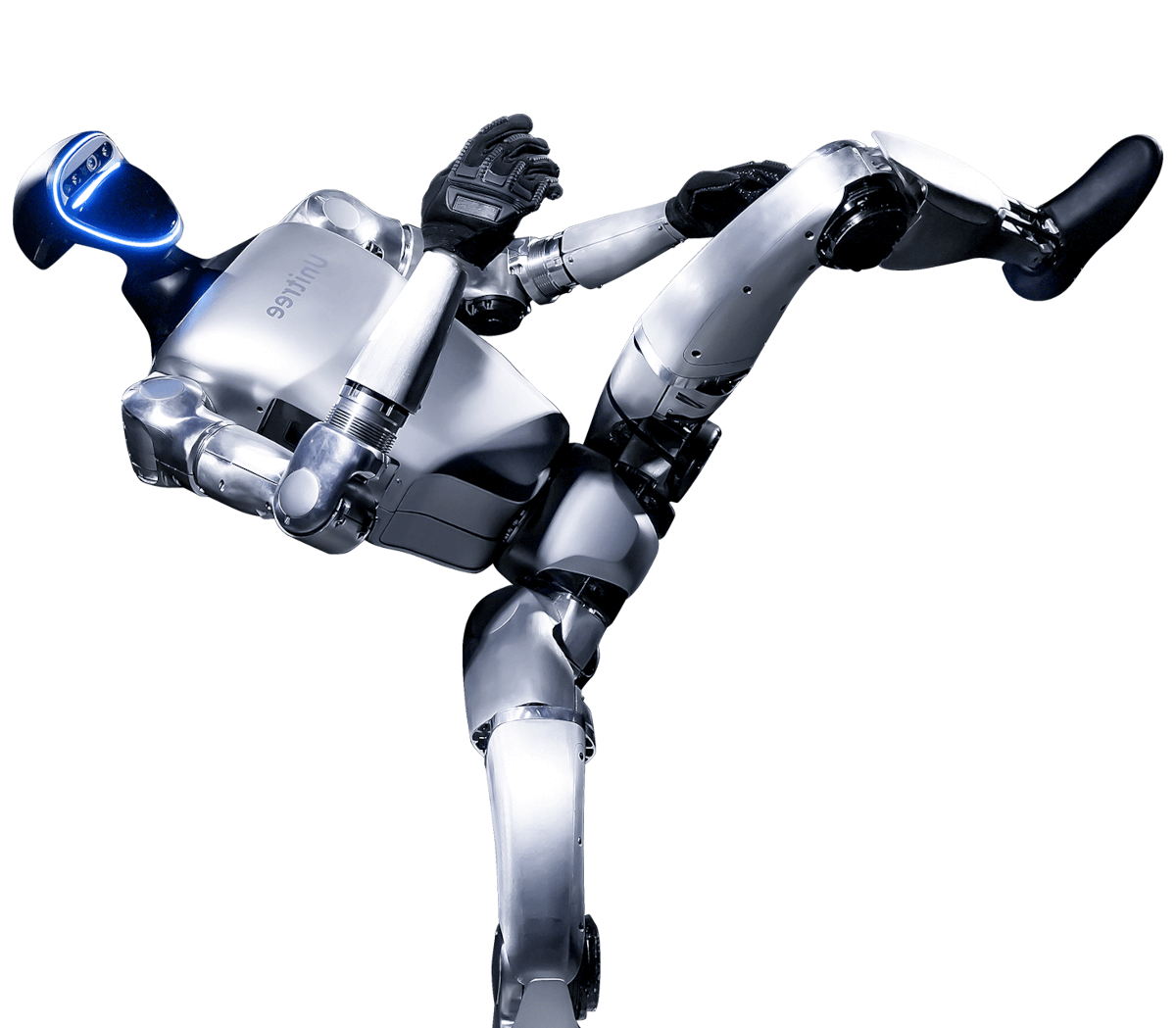

Synergy Tech Robotics deployed AI-powered agents designed to enhance financial operations at FutureWealth Bank. These AI agents were integrated into the bank’s CRM and compliance systems, automating tasks like client inquiries, compliance checks, and data management.

The solution involved:

Automated Customer Support: AI agents handled client inquiries, delivering instant responses and routing complex issues to human representatives, improving overall service speed.

Real-time Compliance Monitoring: AI agents conducted real-time reconciliation of accounts, ensuring accurate and up-to-date financial records.

Data Management & Reporting: AI agents streamlined data verification and reporting, reducing administrative workloads and improving accuracy.

A Success Story in the Financial Sector

Outcome:

The impact of implementing Synergy Tech Robotics’ AI agents was significant and measurable:

55% Faster Client Response: Automated customer support reduced response times, improving client satisfaction and engagement.

30% Cost Reduction: AI agents reduced administrative workloads, resulting in lower operational costs and better resource allocation.

Improved Compliance Efficiency: AI agents ensured faster and more accurate compliance checks, reducing risk and increasing regulatory adherence by 40%.

Scalable Solution: AI agents enabled FutureWealth to handle more client requests and regulatory requirements simultaneously, supporting growth without additional staff.

"Synergy Tech Robotics’ AI agents have significantly improved our banking operations. We’re able to respond to clients faster, maintain compliance efficiently, and cut costs—all while delivering a better client experience."

- Rachel Bennett, Director of Operations, FutureWealth Bank

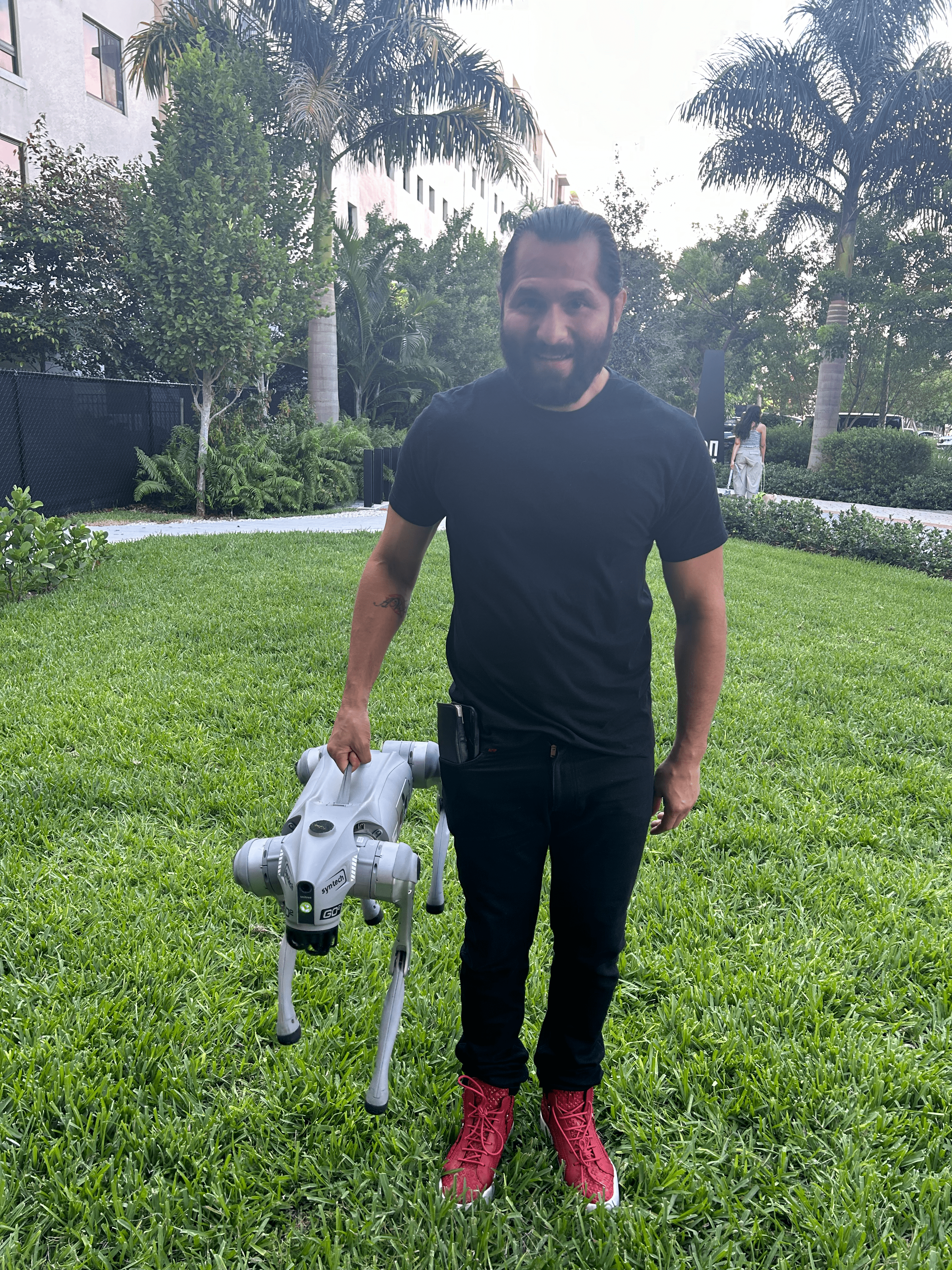

Dario Samaniego

Dario Samaniego is a pioneering jurist and international business strategist with over two decades of experience driving global expansion and forging strategic partnerships across Europe, LATAM, and the United States. A visionary leader he actively accelerates the growth of innovative tech startups.

About Us

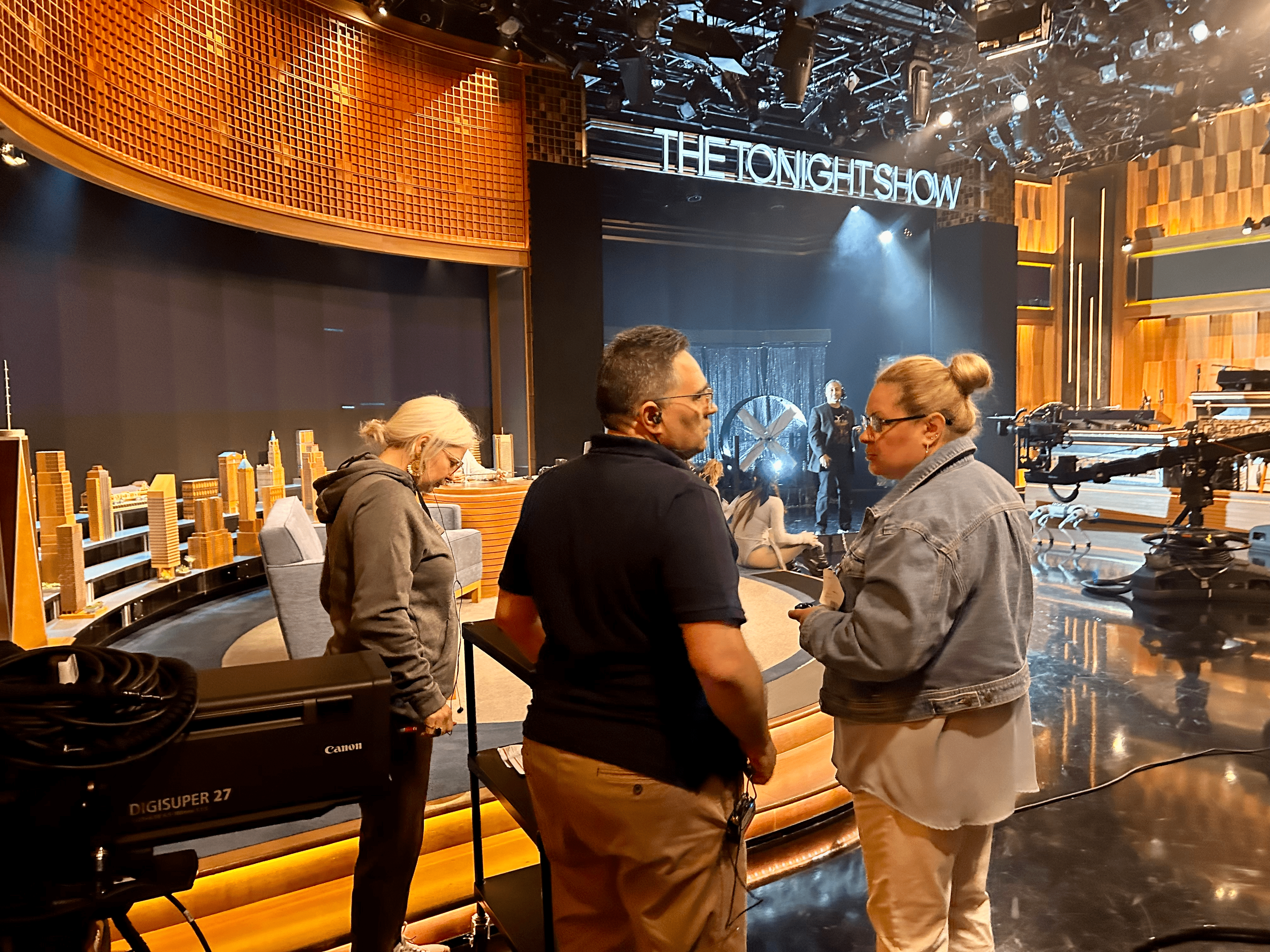

Our Gallery

Free Consultation

Get a Similar Solution for Your Financial Institution

Subscribe to newsletters and get news.

Sign up for updates and Stay Ahead of the Curve with AI Insights

Contact

Synergy Tech Robotics Corporation

info@synergytechrobotics.com

1 (646) 481-9333

© 2026 Synergy Tech Robotics Corporation All rights reserved.